Tuesday, 27th April 2021: The exchange rate between the naira and the US dollar closed at N411.67/$1 at the Importers and Exporters window.

Naira depreciated on Tuesday, at the Nigerian Autonomous Foreign Exchange (NAFEX) window, as the rate closed at N411.67 to a dollar. This represents a N1.67 drop when compared to the N410/$1 that was recorded on Monday, 26th April 2021.

However, the naira remained stable at the parallel market to close at N485/$1 on Tuesday. This was the same rate that was recorded the previous day as the CBN has moved to further boost diaspora remittances with the approval of 10 additional International Money Transfer Operators (IMTO)

Trading at the official NAFEX window

The naira depreciated against the US dollar at the Investors and Exporters window on Tuesday to close at N411.67/$1, the same as recorded on Monday.

- The opening indicative rate closed at N410.05 to a dollar on Tuesday, 27th April 2021, about the same rate that was recorded on Monday.

- Also, an exchange rate of N436.55 to a dollar was the highest rate recorded during intra-day trading before it settled at N411.67/$1. It also sold for as low as N401.10/$1 during intra-day trading.

- Forex turnover at the Investor and Exporters (I&E) window rose marginally by 2.04% on Tuesday, 27th April 2021.

- Data tracked from FMDQ showed that forex turnover increased from $47.45 million recorded on Monday, 26th April 2021, to $48.42 million on Tuesday.

Cryptocurrency watch

The world’s most priced and largest digital asset traded past $54,000 after recovery from its dip over the weekend.

- Bitcoin went up on Tuesday to trade at $55,069 on Tuesday evening amid news in the morning that JP Morgan is gearing up to offer an actively managed bitcoin fund to certain clients.

- CoinDesk said that the move would make it the largest and unlikeliest US mega-bank to embrace crypto as an asset class.

- Meanwhile, Tesla announced $438m in net income for this quarter, with a $101m positive impact on profits from selling some of its bitcoin. It had put $1.5bn into the cryptocurrency earlier this year.

- The price of Ethereum, the world’s second-biggest cryptocurrency in terms of market capitalization and volume continued to rally on Tuesday rising to $2,645.

Crude oil price

The price of crude oil rose on Tuesday, April 26, 2021, as OPEC+ group is holding firm on output cuts.

- Oil prices rose on Tuesday morning on the news coming out of Vienna that shows OPEC+ believes the market will be able to accommodate the higher oil supply as of May 1, despite the worsening of the Covid-19 situation in the world’s third-largest oil importer, India.

- Brent Crude rose by 1.17% to trade at $66.42, indicating an increase of $0.77, compared to the previous day’s price.

- WTI Crude went up by 0.22% to trade at $63.08, Bonny light dropped by 0.42% to trade at $63.94 while Natural Gas currently sells for an average of $2,869.

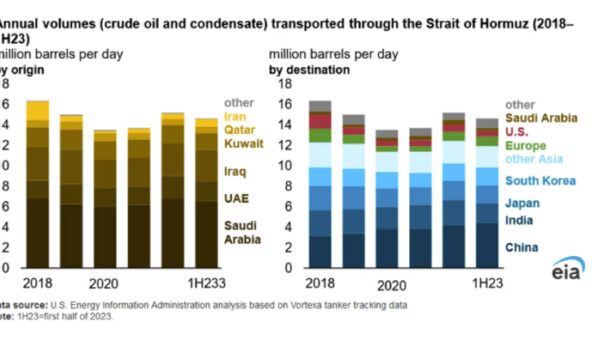

- The increase in the amount of drone and missile attacks on Saudi oil and transportation infrastructure in the last couple of years, is a major threat for international oil and commodity markets in the coming months.

External reserve

Nigeria’s external reserve position dropped by 0.25% on Monday 26th April 2021 to stand at $35.008 billion.

- Data obtained from the Central Bank of Nigeria (CBN), revealed that Nigeria’s external reserve dipped from $35.094 billion recorded on 23rd April 2021 to $35.008 billion on Monday, April 26, 2021.

- This represents the sixth consecutive decline recorded during the week in Nigeria’s external reserve, having had 19 successive growths.

- The growth recorded was attributed to increasing global oil prices and some of the measures introduced by the CBN to boost dollar inflow in the country’s forex market, such as the naira 4-dollar scheme.

You must be logged in to post a comment Login