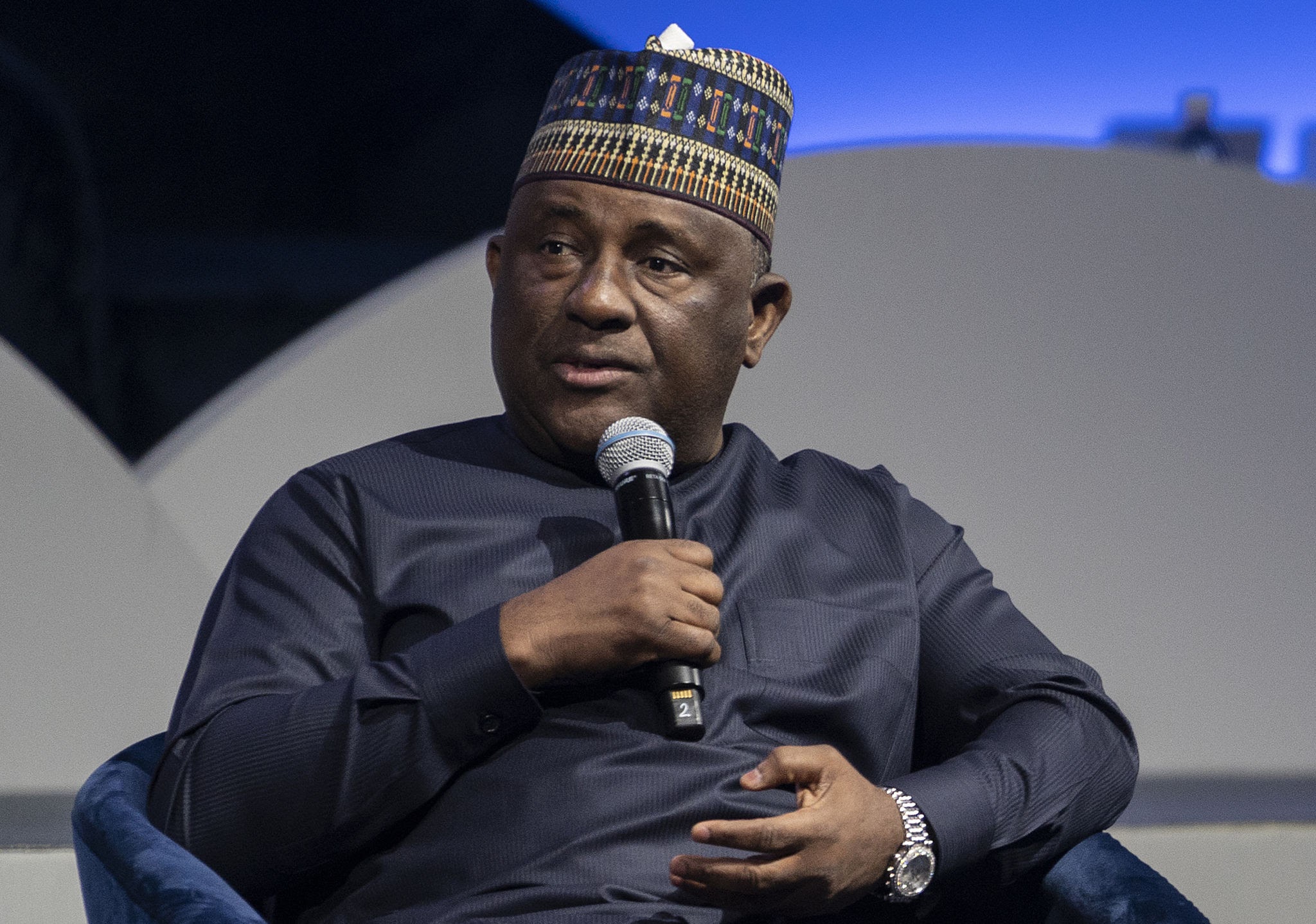

Abdul Samad Rabiu, the astute chairman of BUA Group, has achieved a remarkable feat, eclipsing the iconic Aliko Dangote as the wealthiest investor on the Nigerian Exchange (NGX). This seismic shift in wealth distribution reflects the dynamism of the stock market and investor confidence in Rabiu’s ventures.

Abdul Samad Rabiu’s Triumph

Rabiu attributes his ascension to investor wealth to multiple factors, notably the burgeoning faith in his conglomerate’s stocks and the appealing trajectory of the stock market in recent months.

He accentuates the impact of BUA Group’s impressive Q3 earnings and a recent cut in the ex-factory prices of their cement brand. These strategic moves have bolstered investors’ trust and positively influenced market sentiments.

Wealth Analysis

Valued at an impressive N3.64 trillion, Rabiu’s majority stake of 99.8% in Bua Food stands as the most significant holding on the NGX. Additionally, his substantial stake of 96.29% in BUA Cement, valued at N3.49 trillion, significantly contributes to his burgeoning wealth. Consequently, with a total portfolio valued at N7.13 trillion, Rabiu has strategically outpaced Dangote on the Nigerian bourse.

Dangote’s Standing

Although Rabiu has surged ahead on the Nigerian Exchange, Dangote remains a titan in the business realm. His extensive holdings, particularly an 86.8% stake in Dangote Cement, continue to solidify his position in the market. Dangote’s diversified portfolio also includes significant stakes in Dangote Sugar, NASCON, Jaiz Bank, and United Bank for Africa.

Financial Expert Insights

Charles Abuede, a renowned financial analyst, underscores the recent surge in the share prices of BUA Group’s flagship companies as a pivotal driver in Rabiu’s wealth acceleration, propelling him ahead of Dangote. He emphasizes that Rabiu’s sustained lead is feasible if market conditions remain stable without unexpected disruptions.

Wealth Evaluation

Despite Rabiu’s ascendancy on the Nigerian bourse, Dangote maintains his dominance as the wealthiest individual in Nigeria and Africa. Bloomberg estimates Dangote’s wealth at $16.2 billion while valuing Rabiu’s wealth at $5.62 billion. This disparity, although substantial, doesn’t diminish Rabiu’s remarkable achievement in the investment sphere.

Rivalry and Media Reports

Recent media reports hint at a perceived rivalry between the two billionaires, allegedly involving an exchange deal. Such occurrences, though speculative, underscore the competitive edge in their endeavors and the attention their actions garner.

Market Impact and Conclusion

Rabiu’s remarkable achievement, marking his leadership in Nigeria’s investment landscape, sends ripples across the African industrialist fraternity. His portfolio’s magnitude, comprising 18.31% of the NGX’s total market capitalization, emphasizes his profound influence on the Nigerian Exchange.

In essence, Rabiu’s ascent to the top echelons of Nigeria’s investor elite underscores the dynamism of the country’s stock market and the ceaseless pursuit of excellence by its business magnates. While Dangote remains an indomitable force in the investment arena, Rabiu’s strategic maneuvers have positioned him as a frontrunner on the NGX, setting the stage for an exciting chapter in Nigeria’s business narrative.