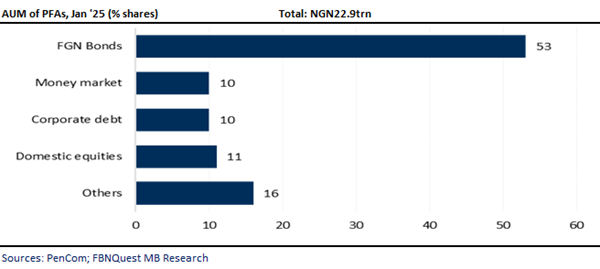

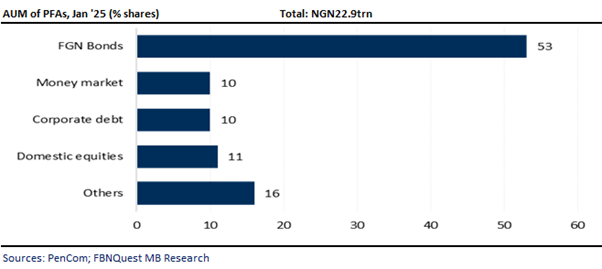

Recently released data from the National Pension Commission (PenCom) show that the total Pension Assets Under Management (AUM) of the regulated pension industry increased by 2% month-on-month (MoM) and 17% year-on-year (YoY) to N22.9trn in January 2025. Excluding a mild decline in the value of money market instruments, all other major asset classes that we track experienced m/m growth in February. Specifically, pension holdings in domestic equities, which were the primary driver of the month-over-month (MoM) gain, increased by N164.5 bn or 7% MoM to N2.4trn. As a result, their proportion of the total AUM rose to 10.5%, from 10.0% in December.

- 1. Nigerian pension funds benefited from the bullish performance of the local bourse in January, as the NGX ASI advanced by +1.5% MoM.

- 2. The Nigerian stock market was buoyed by renewed buying interest in some bellwether stocks. On a YTD performance, the NGX has gained +2.7%.

- 3. Investment in treasury instruments also increased by 13% m/m or N89.8bn to N794.3bn, thanks to the elevated yield environment underpinned by the CBN’s monetary tightening policy stance.

- 4. The value of FGN bonds also experienced modest growth in February, increasing by N67.9bn month-over-month (MoM) to N12.1trn and accounting for approximately 53% of the total Asset Under Management (AUM).

- 5. If we include treasury bills, sukuk bonds and other agency bonds, the value of FGN securities increased by N195.0bn to about N14.3trn. As a result, their share increased to approximately 62.6% of the total AUM, up from 62.7% in December 2024.

- 6. PFAs’ asset allocation to corporate debt securities also improved, as their value increased by N21.0bn MoM to N2.3trn.

- 7. Despite the remarkable growth of pension assets, Nigeria’s pension savings penetration rate (assets/GDP ratio) has hovered around 7% – 8% in recent years, underscoring the underpenetrated state of the industry.

- 8. To broaden pension coverage and boost engagement of pension products, PenCom has ordered all states and local governments across the country to enact and implement the contributory pension scheme.