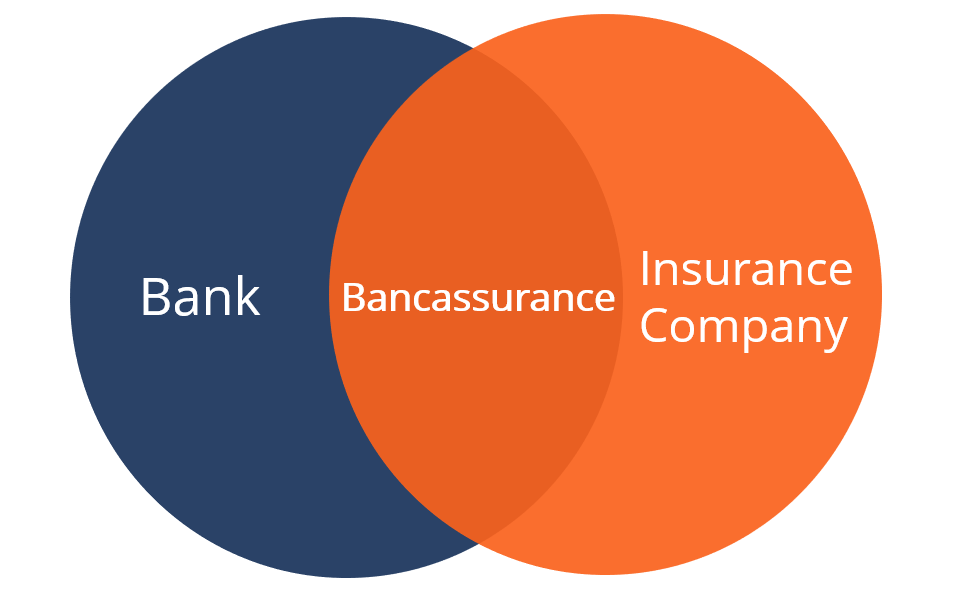

Bancassurance in Nigeria is likely to see renewed vigour as Access Bank Plc and Coronation Insurance rethink business opportunities by partnering to provide cross-selling opportunities across customer journeys of both companies. The digital dictionary ‘Investopedia’ notes that Bancassurance is an arrangement between a bank and an insurer in which an insurance company is allowed to sell its products to the bank’s client base.

The Global Bancassurance market in 2019 was about $1.2bn and has gained popularity across the globe. Looking forward, the IMARC Group expects the market to grow moderately between 2020-2025.

In Nigeria, Bancassurance got a lift in January 2020 when the regulator, the National Insurance Commission (NAICOM) approved 18 applications out of 20 applications sent in by operators to enable them drive the retail business through the bancassurance platform.

“Through the coming together of both organizations, new standards of quality and service delivery will be established within the industry”

As part of efforts to deepen the financial services industry in Nigeria, Access Bank and Coronation Insurance are collaborating to drive an innovative, efficient and dynamic bancassurance system.

Speaking on this development the Group MD/CEO of Access Bank Plc, Mr. Herbert Wigwe, described the bancassurance partnership as extremely significant to the ecosystem.

According to Wigwe, Coronation Insurance is leading within the various categories, with customers benefitting from the best claims payout experience, hence the Access Bank partnership.

He noted that Coronation Insurance was among the top 3 most capitalized Insurance businesses in the country. Wigwe said “In fulfillment of more than a bank promise to you we want our customers to have the best underwriting and claims experiences. We believe that this is possible, and with a bank assurance partnership in the company of Coronation Insurance it will be achieved“.

Wigwe emphasized the importance of risk management and governance in the business operations of Insurance companies. According to him, several insurance companies in the past have been sluggish or slow to meet the various claims made by their customers. He believed Coronation Insurance would experience total transformation with the partnership.

On his part, Mr. Mutiu Sunmonu, the Chairman of Coronation Insurance Plc., giving his remarks about the partnership, said it would expand the service delivery pipeline with Access Bank.

Speaking on his experience since joining the board of Coronation Insurance, Sunmonu said he had been impressed by the qualities of the organization, including;

- The digital maturity of the organization and the size of investments the organization has made in scaling its digital maturity over the last decade.

- Governance and financial capacity and

- Talent/Potentials within the organization

Sunmonu noted the partnership between Access Bank and Coronation Insurance represents a major milestone for the Nigerian Insurance Industry. “Through the coming together of both organizations, new standards of quality and service delivery will be established within the industry,” he said.

Amongst others the partnership will elevate the level at which Insurance and banking service is delivered to corporate customers in the country, marking the level of growth recorded in the banking sector over the last two decades. only over a shorter period.

The Bancassurance partnership comes at a critical time the Nigerian Insurance Industry is undergoing a recapitalization which according to Coronation Research, will move insurance from the “Lagoon to the Ocean” if managed effectively.

The partnership discussion between Access Bank and Coronation Insurance was part of the webinar themed “Managing Risks That Keep CEOs Up At Night“, which held on October 07, 2020 and featured Mr. Simon Norris, Partner, Trinity LPP; Mr. Bode Agusto, Founding MD/Bode August & Co; and Mr. Nico Conradie, CEO Munich Re of Africa.