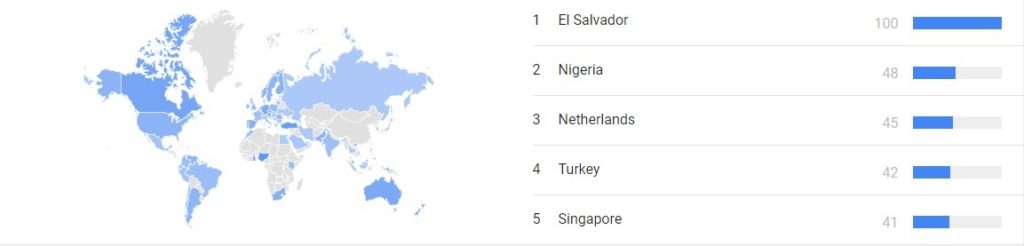

Nigeria has been rated the second country most interested in bitcoin, despite the difficulty of accessing the trillion-dollar crypto in the country.

As evidenced by data from Google trends, the financial market turmoil caused by COVID-19 has definitely changed the way Nigerians view the entire financial system, with Nigeria among the leading countries in bitcoin searches.

Based on local geographic metrics, Delta, Anambra, Bayelsa, Edo, and Enugu rank as the top five states with the highest interest in Bitcoin in Nigeria.

This is coming on the backdrop that CBN has intensified its campaign against cryptocurrency traders and is now targeting entities and individuals that provide P2P platforms or services to customers who trade crypto assets

Nairametrics previously reported that some banks arbitrarily froze bank accounts of individuals suspected of trading cryptocurrency as part of the CBN’s renewed crackdown.

Since Nigerians are among the most tech-savvy in the world, it’s very easy for them to adopt bitcoin use. In spite of this, youth in Nigeria aren’t the only ones adopting bitcoin.

Earlier this year, the Central Bank of Nigeria denied crypto companies access to the banking ecosystem, causing many cryptocurrency businesses to close up shop. Other companies were also forced to scale back their operations using P2P systems due to the same blockade.

Flutterwave, Paystack, and Monnify are among the crypto exchanges that partner with NBFIs and OFIs to transact with bank customers in Nigeria. This allows them to accept debit cards and direct transfers. Those companies cannot continue providing these services based on the instructions in the circular.

Why CBN is kicking against Bitcoin

Cryptocurrency is considered illegal money by the CBN. “Currently, cryptocurrency does not belong in our monetary system, and cryptocurrency transactions should not be carried out through Nigerian banks,” the CBN had stated.

The Nigerian apex bank says the anonymity, untraceability, and speculative nature of cryptocurrencies is causing them to be increasingly used for money laundering, terrorism funding, and other criminal activities

Considering a large percentage of Bitcoin transactions are remittances, this was always going to be a concern for the Nigerian Central bank, which views remittance control as a way to achieve its exchange rate objectives.

Another possible reason for the ban is the use of crypto during the #EndSARS protest. During the anti-police brutality protests that rocked Nigeria in October 2020, young people resorted to crypto assets as a way to avoid CBN restrictions on their accounts.

Why Nigerians love bitcoin

As a fiat currency, the naira is susceptible to inflation and devaluation, A significant number of Nigerian youths prefer to store assets in bitcoins or stablecoins thus would rather pay a premium via P2P trading which is increasingly becoming difficult amid the CBN crypto ban

Compared to existing traditional channels, bitcoin’s transactions are extraordinarily easier to execute due to their borderless nature.

Bottomline

Bitcoin has outperformed any Nigerian assets since its emergence. A growing number of Nigerians are not giving up owning one of the most disruptive financial asset classes in human history. They are therefore, willing to pay a premium to hold on to crypto regardless of the central bank’s ban.

Article Originally Published Here

You must be logged in to post a comment Login