It’s a new year, and everyone is looking to start on a good note. Most people have drawn up goals, plans and resolutions they hope would guide their lives throughout the year, so have governments. Towards the end of last year, the Nigerian government passed its 2022 budget and even laid down a new medium-term development plan.

But 2022 is not like every other year.

It’s the year before the general elections, and it is also the final year the Buhari government spends in power because every president is entitled to just two tenures (four years each). Therefore, regardless of how you feel, the Buhari government will end in 2023.

Some takeaways:

- Pre-election years are when governments, including Nigeria, double down on spending or control their income through taxes to win voters. But Nigeria has long depended on oil revenue and, until the present administration, did not earn much revenue from taxes.

- The implication of such changes in the policy direction of an economy is diverse. For instance, government spending before an election might suggest higher inflation. However, the reverse has been the trend in the years preceding Nigeria’s past elections.

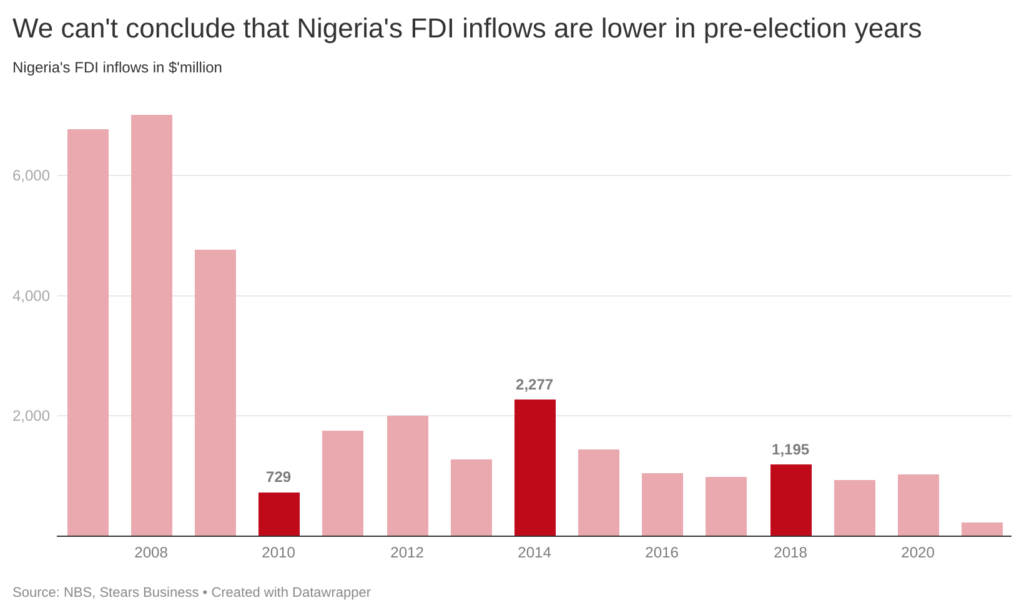

- Investment is another trend that can change during a pre-election year. Foreign direct investment has a reputation for exiting during pre-election and election years, primarily due to the uncertainty of having a new government. But previous data from previous years show we can’t conclude that FDI’s reduce in pre-election years.

This election is also quite important to Nigerians because the economy has suffered two recessions in the last five years; inflation and unemployment are also at alarmingly high rates. So, Nigeria is desperately in need of some fiscal guidance.

Our finance minister has rolled out a budget for 2022, which maps out how much Nigeria intends to spend and how these expenses will be funded, whether by revenues or borrowing. Undoubtedly, the government needs to spend more. But with debt to revenue ratios hovering between 80% – 90% and declining revenues, there’s also not much room for this government to flex its muscle to spend significantly more this pre-election season.

So, this government is between a rock and a hard place. The rock is its funding constraints. The hard place is the spending it needs to do to get Nigeria’s economy growing faster—and, more cynically, preserve the political party’s reputation for the next election. To know whether this is a situation that can be resolved, we need to answer a few questions.

We’ll start with this:

How do elections affect developing countries’ revenues and spending?

Despite the borrowing constraints, knowing it’s their last year in power, and preparing for an election in 2023, we expect the government, in its usual fashion, to increase borrowing to fund its budget.

To impress the public and better the APC’s odds of winning another election, the government could complete its previous projects or roll out new ones. This is the last chance for this administration to leave a positive legacy.

But this situation isn’t peculiar to Nigeria. In a study of over 15 developing countries, researchers found that governments implement expansionary fiscal policies like tax reduction or increased spending when an electoral cycle is approaching, especially when the election is competitive. And competitiveness, in this case, ranges from having multi-party elections to when the opposition party is so influential that the margin of success between the top two parties is quite slim.

Another paper by the IMF analysed over 60 countries and recorded the same situation in low-income countries. These countries tend to increase their spending before and during the election year. But, governments tend to tighten their purse strings and reduce spending shortly after the polls to make up for the excesses it spent in the years before.

These changing patterns also affect government revenues. On the one hand, governments reduce the taxes individuals have to pay to increase their re-election chances. But on the other hand, they increase trade and corporate taxes, which shrink investment or commercial activities. When the elections are over, governments start to retrace their steps to get back the money lost pre and during the elections. However, the businesses which should provide jobs for individuals the government is looking to get taxes from are typically in distress and so won’t be able to employ these individuals or pay them sufficiently.

Nigeria’s elections are the definition of competitive with the APC and PDP’s tension-fraught battle for the presidential seat. But does Nigeria’s revenue and spending follow the data on developing countries that increase during pre-election years? Let’s start with revenue.

Interestingly, the Nigerian government’s revenue source does not change whether or not elections are lurking in the corner. It is still made up of oil and non-oil revenue. The oil revenue is, to an extent, beyond our control because the crude oil price is determined by international markets, which we have no control over. But we can manipulate the quantity, as I explained in this article. Revenue is a function of price and quantity. Essentially, crude oil prices are determined by global demand and supply for oil and other substitutes. Still, by maximising the crude oil quantities we produce, Nigeria can considerably maximise its oil revenue.

However, while oil revenue is partially beyond our control, non-oil income comprises VAT, trade taxes, and other corporate taxes. And here, the government can exert some control. As I mentioned earlier, developing countries flex their muscles by reducing taxes to endear the population to themselves.

But Nigeria has long depended on oil revenue and, until the present administration, did not earn much revenue from taxes. Therefore, unlike other developing nations, the Nigerian government was never interested in reducing income taxes or increasing corporate taxes. And why bother when oil revenues were sufficient?

So, past governments focused on maximising oil revenues and ignored non-oil revenues to curry the favour of Nigerians.

But while the trend of the Nigerian government’s revenue is clear, the government spending trend isn’t so obvious.

The data doesn’t show a significant trend. In some years, government spending increased compared to the previous year, and in other years, it decreased.

However, we need to pop the hood and dig a little deeper to uncover how government spending in pre-election years unfolds.

Nigeria’s unique spending situation

One way the government increases spending is through its proposed policies. Let’s call them proposed because they are campaign promises used by political parties and governments to increase their re-election chances.

A good example of this is the minimum wage situation in Nigeria. In 2010, the Nigerian Labour Congress (NLC) went on strike to request an increase in the minimum wage from ₦7,500 to ₦18,000. The request was reflective of the inflation in the economy at the time. The government met with the NLC and promised to speed up its legislative process to increase the minimum wage.

The NLC knew how rolling out a strike close to another presidential election was detrimental to the next voting cycle, which was why 2010 was a strategic year. Few months after the strike, a few weeks before the presidential elections, the government passed the bill for ₦18,000, as the minimum wage, into law.

The NLC began to clamour for another minimum wage increase eight years later. And that was not without reason. Nigeria had just exited a recession which had increased inflation to over 18%, only slowing down to 15% at the time when the NLC was requesting a minimum wage.

So, in 2019, months to the election, the government passed the bill to make ₦30,000 the new official minimum wage. The NLC has requested a minimum wage review again. Given the significant increase in inflation in the past year, it’s understandable because inflation has shrunk people’s pockets.

However, it is unlikely that the government will consent to the review because the other years, when the minimum wage bill was passed, the incumbent government was running for another term. However, this time, the government has spent the maximum number of years it can in power and has less reason to encourage the people to re-elect it into power.

This also means the government can make some bold and politically unpopular policies since it’s on its way out. One of such policies is the removal of fuel subsidies.

As we highlighted in this article, fuel subsidies continue to eat into the Nigerian government’s purse, with the government spending as high as ₦1.3 trillion in less than a year to keep the domestic fuel price low. Previous administrations have attempted to remove the subsidies, but there has been significant pushback because subsidy removal increases fuel prices and makes transportation costly.

However, there have been partial removals and an announcement that the government will replace the subsidies with a new welfare program to provide ₦5,000 to poor Nigerians. That policy does two things for the government. First, it means more money directly in the hands of Nigerians, which the government will be willing to do during a pre-election period. It also means the government can get away with a significant spending hiccup that other administrations have been unwilling to try.

The ability of this strategy to yield the desired results of Nigerians re-electing the party in power lies in the transparency of the initiative. How many people it can cover, and how far it can go to ease the economic hardship of Nigerians?

Uncertain investments

While the government makes big, bold decisions, investors are bound to sense the uncertain future with new elections. It’s one thing to invest in Nigeria and another thing to invest in Nigeria before an election where an incumbent government will be unseated. As an investor, you’re unsure of whether the incoming government will support your business and sector or not. One policy change from an incoming government can change the trajectory of businesses or even cause them to cease to exist. Hence investment in Nigeria starts to shrink between the pre-election and election years.

Foreign direct investment, in particular, has a reputation of exiting during pre-election and election years, primarily due to the uncertainty, as I have explained before. However, this reputation does not quite play out in the data for Nigeria. Admittedly, our sample size is small as we only have FDI data available for four pre-election years (2010, 2014, and 2018). So, although investor sentiment is weaker in pre-election years, we cannot conclude that it feeds through to lower FDI.

Even more positively, it is likely that venture capital investment in the tech ecosystem—the recent star of Nigeria’s investment—will be even less affected by pre-election uncertainty. This is because investors in startups tend to take an even longer-term horizon. Taking a cue from 2018; despite just coming out of a recession and with an election ahead, investment in startups increased by 28% in 2018. Of course, 2018 is different from 2022 because the new election comes with a whole new government, whether the power continues to reside in the same political party or not.

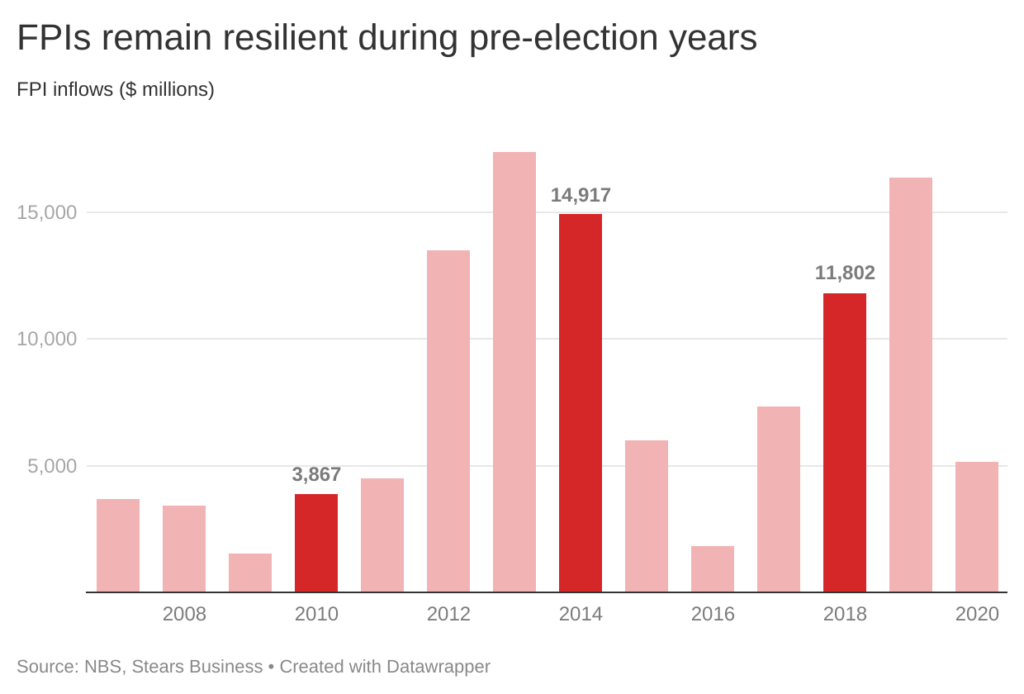

Another class of investment that seems to hold up well in pre-election years is the foreign portfolio investments class. It is worth pointing out that this is contrary to what we would expect as the uncertainty of pre-election years induces volatility that could scare foreign investors. Of course, there are other issues to consider. For example, higher government spending leading to more borrowing and higher interest rates in government bonds might entice foreign investors into the market.

FPIs are usually short term investments, so investors are willing to cash in on the economy one last time before they exit. Likewise, the number of deals in the Nigerian stock exchange barely changes in pre-election years, indicating investor confidence in the economy during the pre-election years.

Once again, the big caveat with this data is the sample size. Nigeria has only had a few elections, and investment data is mainly available post-2007. Given that a lot of the data is at odds with conventional economic wisdom, there is still debate over the overall impact on investment.

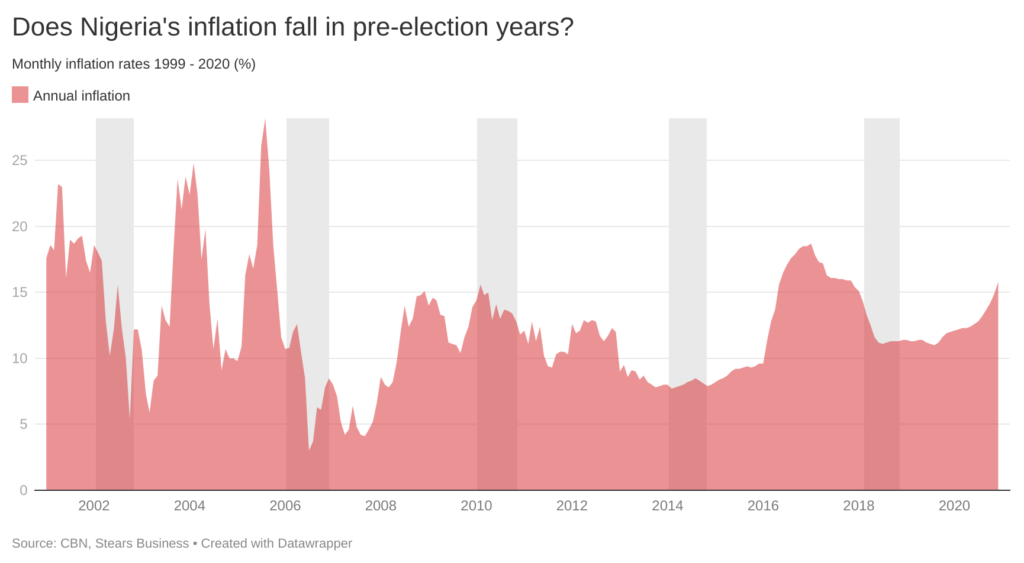

Expect inflation to cool down

The final issue worth exploring is how local prices will behave in a pre-election year. If governments increase their spending, basic economics suggests that inflation should rise. Once again, the data does not match that thinking. In fact, Nigeria’s inflation dips noticeably in pre-election years, as you can see below.

The shaded regions represent pre-election years and you can see that we have five of those, so, once again the small sample caveat applies here. But there does seem to be a trend (particularly pre-2011) of lower inflation just before and just after elections.

Will that happen again in 2022?

Well, the main reason for the super-high inflation rates we’re currently facing in the country is food inflation, which is mostly triggered by herdsmen clashes, lingering effects of border closures, and the cost of transporting food into and across the country. For food inflation to reduce, the clashes between herders and farms would need to be curbed significantly, or the access to food will have to increase (through improved importation).

With oil prices expected to go back to pre-pandemic levels and OPEC production restrictions lifted completely, we’ll see our oil revenue increase again, leading to more stable foreign exchange. The net effect should be more stability in food imports than we have seen in the last eighteen months.

However, the impact of the supply chain logistics within the country might remain.

Moreover, Nigeria’s inflation is still mainly domestic (imported food accounts for less than 15% of Nigeria’s inflation basket), so the issues mentioned above (food transport, etc.) will play a more significant role. Furthermore, significant policy changes like petrol subsidy removal, a higher minimum wage, or electricity tariff hikes would cause an upward spike in inflation. These are harder to predict, given the significant policy ramifications.

Ultimately, though, it is likely that 2022 will be another pre-election year with lower inflation, simply because the issues that have plagued food prices are coming under control. Even the Ministry of Finance and IMF expect this, as outlined in our five-year outlook for the Nigerian economy.

Unfortunately, the average Nigerian is unlikely to feel this reduction in inflation. Prices will still rise, just slightly slower than they have done in the last eighteen months.

The Nigerian economy is still suffering from the impacts of two recessions in four years that have affected businesses and economic sectors. Currently, the government has very little leeway to borrow to stimulate the economy, even though that has not stopped the present government from borrowing some more.

The recent passage of a ₦17 trillion budget for 2022 suggests that the government has no plans to slow down its spending. Like it or not, in 2022, the government plans to spend, spend, spend.

You must be logged in to post a comment Login