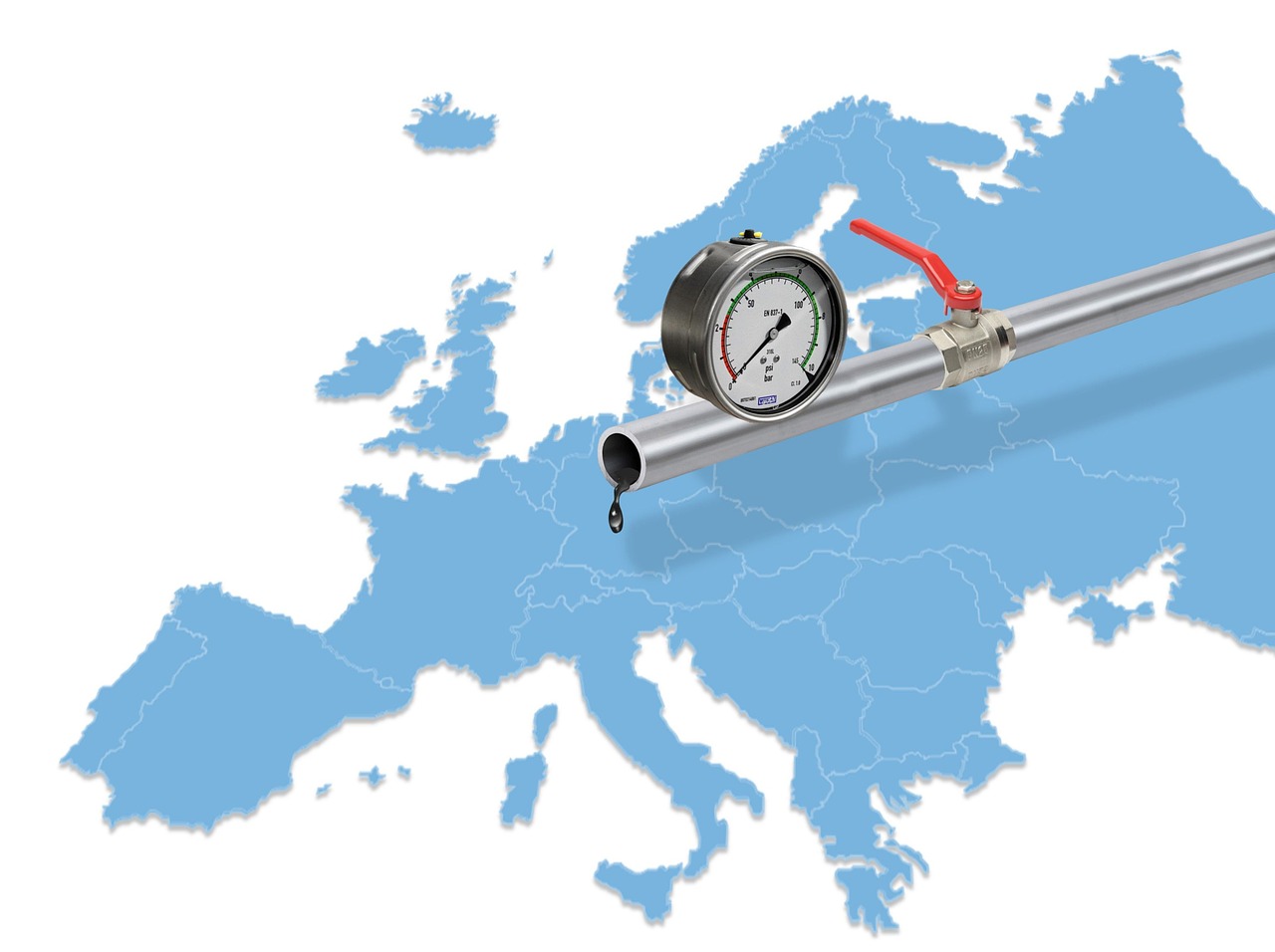

Kremlin Denies Plans for Crude Oil Supply Increase

According to Reuters the Kremlin has affirmed that there are no plans to increase crude oil supply to compensate for Russia’s fuel export ban, denying any discussions with the OPEC+ group. Kremlin spokesperson Dmitry Peskov emphasized their commitment to OPEC+ agreements.

Russia’s Pledge to Cut Oil Output and Export Reduction

In alignment with OPEC+ actions, Russia has pledged to reduce its oil output by 500,000 barrels per day, constituting approximately 5% of its production. Additionally, Russia committed to decreasing crude oil exports by 300,000 barrels per day, measured against May and June’s average export levels, until the end of the year.

Addressing Fuel Shortages in Russia

Russia has recently faced gasoline and diesel shortages, causing concerns in one of the world’s major oil-producing nations. Experts attribute this crisis to various factors, including maintenance at refineries, rail transport bottlenecks, and the devaluation of the Russian ruble, which incentivized fuel exports.

President Putin’s Directive to Stabilize the Fuel Market

President Vladimir Putin has taken decisive action, instructing the government to collaborate closely with companies to stabilize the fuel market. While administrative measures are deemed unnecessary, a concerted effort will be undertaken to address the issue.

Russia’s Ban on Fuel Exports: Duration and Impact

On Sept. 21, Russia imposed a temporary ban on gasoline and diesel exports to all but four former Soviet states in response to domestic fuel shortages. This move disrupted global trade, already grappling with Western sanctions on Russian fuel exports.

On Sept. 25, Russia eased some restrictions, permitting the export of bunkering fuel for select vessels and high-sulfur content diesel. However, importers must still seek alternative suppliers until Russia rebuilds its stockpiles.

Factors Contributing to the Fuel Crisis

The fuel shortage in Russia, a major oil producer, stems from a combination of factors. These include maintenance work at refineries, rail transport bottlenecks, and the ruble’s depreciation, which made exporting fuel more lucrative.

Impact on Global Fuel Markets

Diesel, in particular, will be significantly affected since Russia is the world’s leading seaborne diesel exporter, just ahead of the United States. Russia shipped over 1.07 million barrels per day (bpd) of diesel from the beginning of the year to Sept. 25, constituting more than 13.1% of total seaborne diesel trade.

Gasoline, however, is a less significant export for Russia, with an average of 110,000 bpd in the year to Sept. 25.

Duration of the Ban

While Russia has stated that exports will resume once the domestic market stabilizes, no precise timeline has been provided. Analysts suggest that the diesel ban could last up to two weeks, while the duration of the gasoline ban remains uncertain, with estimates ranging from a couple of weeks to up to two months.

Who Will Be Most Affected Globally?

Following the European Union’s ban on Russian fuel imports due to the Ukraine crisis, Russia redirected its exports to Brazil, Turkey, North and West African countries, and Gulf states in the Middle East. A prolonged diesel export ban could compel Brazil to replace a substantial portion of its fuel imports, potentially up to 400,000 tons per month.

Turkey, a significant destination for Russian diesel supplies, will still have access to Russian high-sulfur gasoil.

Alternative Fuel Supplies

African nations are expected to turn to gasoil and diesel shipments from the Middle East, India, and Turkey. Latin American importers may seek supplies from the U.S. Gulf Coast and the Middle East. Furthermore, European suppliers from Northwest Europe may step in to fill the void left by Russia’s gasoline ban.

Impact on Europe

Change in Fuel Trade Flows and European Implications

Europe, in its quest for alternative suppliers following the ban on Russian fuel imports, has been seeking sources from the Middle East. Increased competition for these supplies is expected due to Russia’s ban, which could subsequently impact Europe. Northeast Asian refiners in China and South Korea may also boost diesel exports to Europe to meet the rising demand.

China recently exported approximately 190,000 tons of diesel to Europe in September, with an additional 45,000 tons slated for October loading, destined for Western countries. This shift in trade dynamics underscores the global repercussions of Russia’s fuel export ban.

Conclusion

Russia’s fuel export ban has sent ripples through global markets, affecting diesel and gasoline supplies worldwide. As the situation evolves, the international community closely watches for updates on when Russia will lift its export restrictions and how alternative suppliers will fill the void left by this disruption.

You must be logged in to post a comment Login