The banking sector, despite weathering the storms of the past 18 months, finds itself on the cusp of a significant transformation.

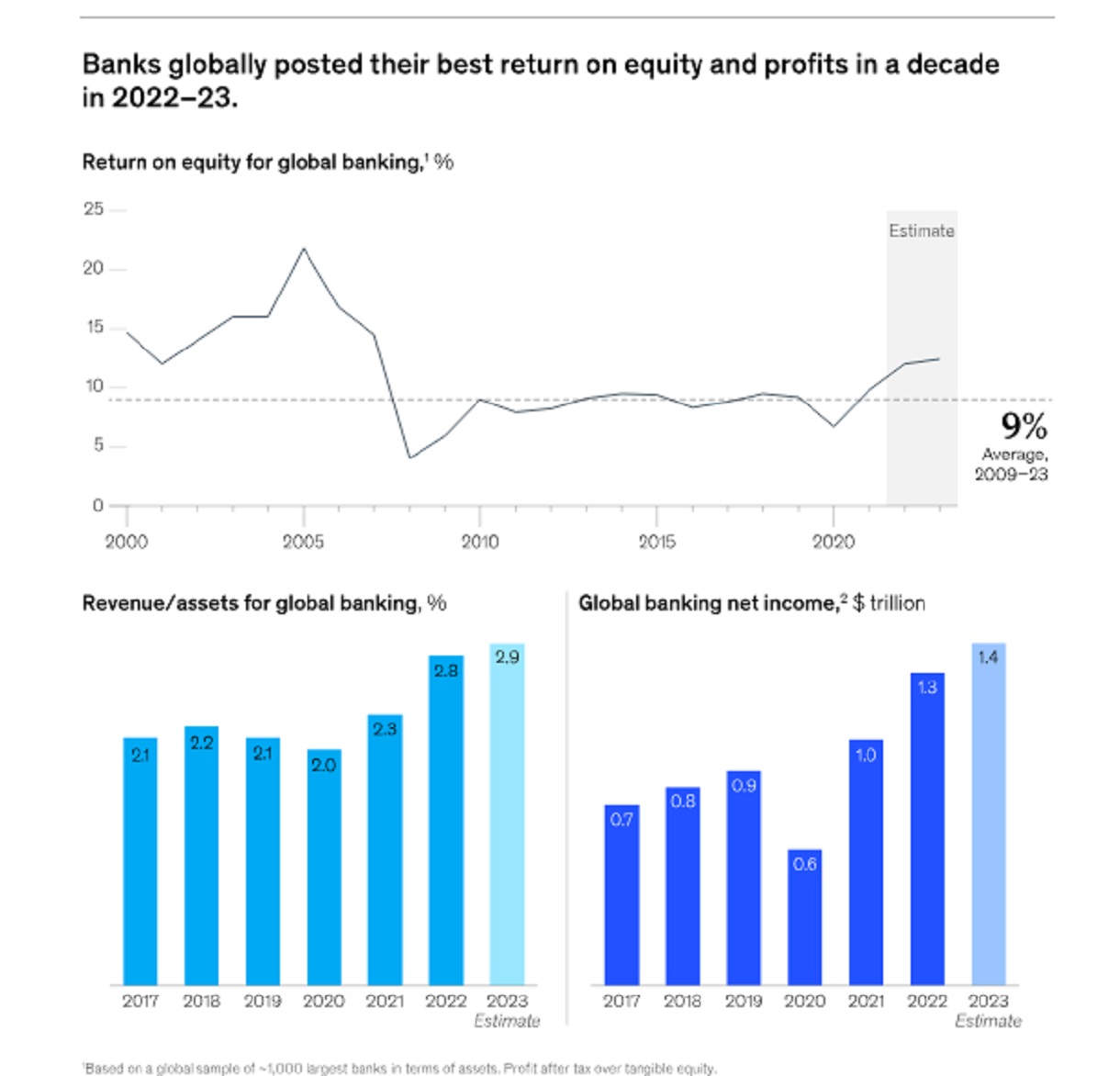

McKinsey’s Global Banking Annual Review for 2023 highlights that, despite the highest profits in over a decade, financial institutions are compelled to reinvent themselves in response to a multi-decade evolution.

Alexander Edlich, a senior partner at McKinsey, emphasizes that this historic opportunity extends across balance sheets, transactions, and payments.

The Evolving Risk Landscape

McKinsey identifies three pivotal global trends shaping the banking industry’s future: the shifting macroeconomic context, regulatory changes, and the influence of technology.

The macroeconomic dynamics, including rising interest rates, inflation, and China’s potential economic slowdown, signal the onset of a new era. Simultaneously, heightened regulatory scrutiny, such as the Basel III Endgame reforms, is poised to alter capital requirements for large and medium-sized banks, impacting strategic decisions and investments.

The technological landscape offers a paradoxical scenario for banks. While generative artificial intelligence promises a 3% to 5% boost in productivity, accompanied by a reduction in operating expenditures of $200 billion to $300 billion, the surge in cyber risks necessitates constant vigilance. McKinsey suggests that technology-driven risks have become a massive driver of investment spending and a major concern for management, boards, and regulators.

Data Ownership and Velocity

Miklós Dietz, a co-author of the report, emphasizes the defining role of data, which is set to be regulated in terms of ownership. He contends that data could either become the new oil, controlled by a select few, or the new water, accessible as a utility for everyone. Importantly, the speed at which risks can impact global businesses has increased exponentially, with changes happening in days and weeks that previously took a year.

Dietz further notes that many banking CEOs have found the current environment particularly challenging, not necessarily due to adversity but because opportunities themselves can be stressful. To navigate this landscape, banks must expand their risk capabilities beyond traditional credit and operational risk, adopting what Dietz terms “agile 2.0.”

Agile Governance and Unbundling Strategies

Agile governance, according to Dietz, involves true agility, going beyond traditional approaches. This includes strategies like unbundling, where businesses may shift operations off balance sheets to distribute risks more broadly or separate customer-facing businesses from banking-as-a-service models. Drawing parallels with the telecom and semiconductor sectors, McKinsey underscores the importance of not attempting to do everything under one roof, advocating for a more flexible and strategic approach.

Regional Dynamics: A New Centre of Gravity

Contrary to the focus on BRICS nations in recent years, McKinsey’s report reveals a substantial reshaping of growth dynamics. While banking sectors in Asia, Latin America, the Middle East, and Africa are outpacing their developed counterparts, attention has shifted away from BRICS, except for India.

The Rise of the “Indo Crescent”

Miklós Dietz asserts that the term ’emerging markets’ and reference to BRICS no longer capture the true value creation geography in banking. Instead, a new center of gravity, termed the “Indo Crescent,” has emerged along the coastline of the Indian Ocean. This region, comprising financial hubs like Dubai, Mumbai, Nairobi, and Singapore, represents only 8% of banking assets but contributes a staggering 52% to banks truly creating value in terms of profitability and stock market valuation.

Leapfrogging Opportunities

The report introduces the concept of “leapfrogging,” particularly relevant for challenger banks in the Indo-Crescent area. With less historical baggage, these banks find it easier to reinvent their business models, as exemplified by the development of highly digitalized mobile payment systems in Africa. Banks in India and Southeast Asia have showcased creativity in not just banking but extending beyond, turning themselves into technology platforms.

Global Growth Potential

McKinsey predicts that the Indo-Crescent area has the potential to drive global growth over the next decade. Between 2021 and 2030, these economies are expected to grow at 7.3% per year, outpacing the BRICS (excluding India) at 6.0% and the rest of the world at 4.3%. This growth, fueled by leapfrogging opportunities and strategic adaptation to risks, positions the Indo Crescent as a key player in the future landscape of banking.

In conclusion, the banking sector stands at the crossroads of change, propelled by evolving macroeconomic, regulatory, and technological landscapes.

The ability to navigate these changes, adopt agile governance, and leverage regional growth dynamics will define the success of banks in this new era of value creation. As financial institutions embrace innovation and strategic unbundling, the Indo Crescent emerges as a pivotal force, challenging traditional notions of banking geography and driving global growth.

You must be logged in to post a comment Login