Nigeria’s inflation crisis has been unveiled

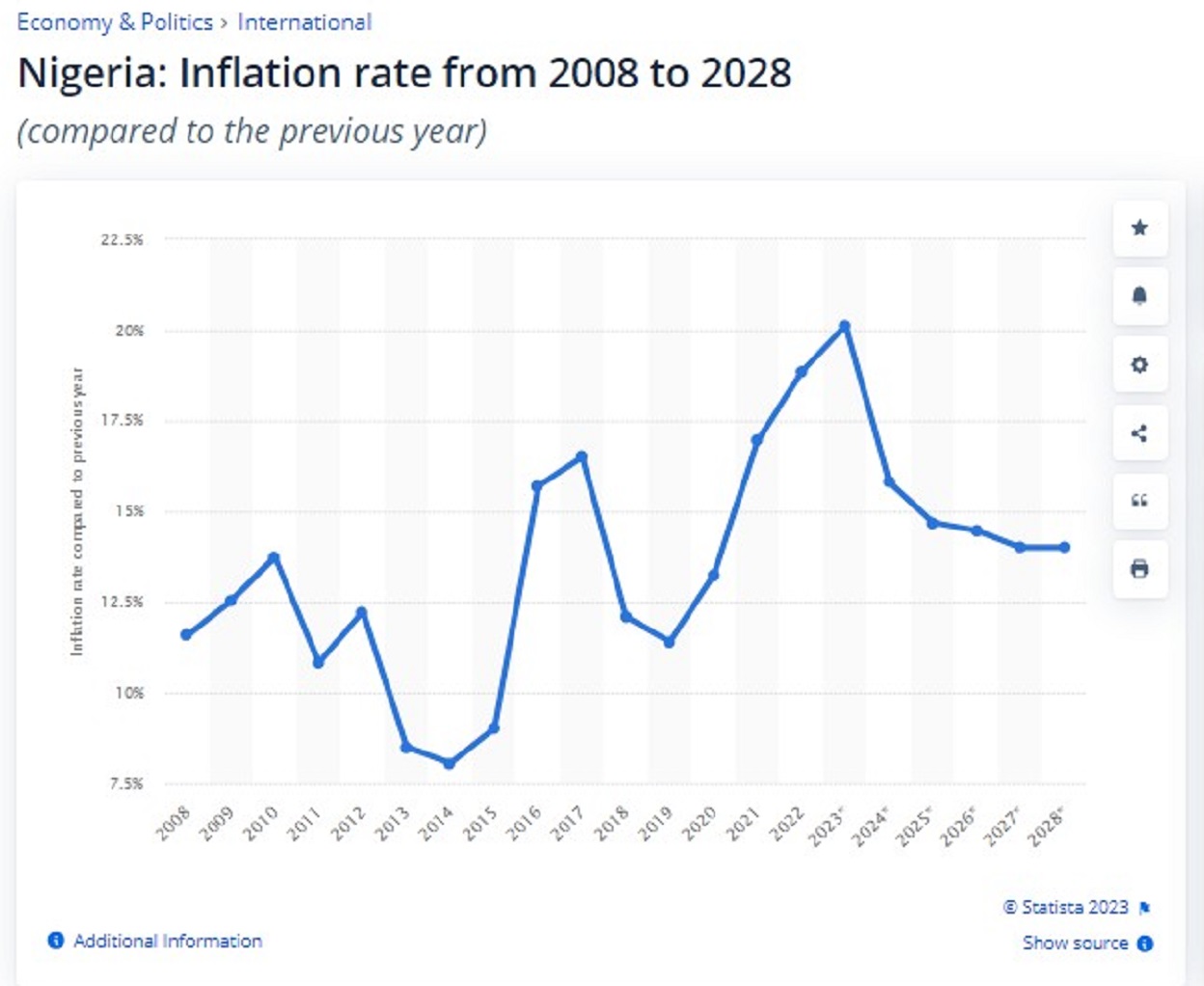

Nigeria is currently grappling with an unprecedented cost-of-living crisis, witnessing a staggering surge in inflation, reaching an alarming 27.33% in October. This surge marks a troubling milestone, placing the country in the throes of its most severe economic challenge in nearly two decades.

The Disturbing Inflation Landscape

At the forefront of this inflation surge are states like Lagos, Kogi, and Rivers, where inflation rates have soared well beyond the national average. Kogi registered an alarming 34.20%, while Rivers and Lagos followed closely at 31.44% and 31.23%, respectively. These figures paint a bleak picture of the escalating prices and financial strain experienced by Nigerians across various regions.

Unveiling the Root Causes

Central Bank’s Optimism Amidst Escalating Rates

Despite this persistent surge in inflation, the Central Bank of Nigeria (CBN) remains cautiously optimistic. The recent decline in headline inflation, from 2.10% in September to 1.73% in October, has provided a glimmer of hope. The CBN attributes this deceleration to its tightened monetary policies and reforms in the money market, signaling a potentially positive impact on curbing the inflationary tide.

The Voice of the Affected

Mrs. Grace Onofomi’s Perspective

Educator Mrs. Grace Onofomi shares a grim reality: prices of everyday essentials have witnessed drastic hikes. From milk to pasta and sugar, the market has witnessed a substantial surge in prices. A stark example is Dano full milk, which escalated from N4,800 to N5,300 within a short span.

Irene Smith’s Struggle

Abia State-based banker Irene Smith echoes the distress, expressing the challenge of subsisting on her current salary amidst escalating commodity costs. Her monthly compensation now barely sustains her for two weeks, underscoring the severity of the crisis.

Josephine Umoren’s Experience

In Uyo, businesswoman Josephine Umoren highlights the unbearable burden of surging commodity prices. As a fashion and cosmetics entrepreneur, she witnessed an almost tripling of prices within just six months. Her struggle reflects the plight of many Nigerians trying to navigate the volatile market.

The Harsh Reality: Impact on Everyday Nigerians

Financial Strain and Survival

For many minimum wage earners, survival has become an overwhelming challenge. A stark revelation from SBM Intelligence indicates that a staggering 50% of Nigerian minimum wage earners exhaust their entire salary on food alone, reflecting the intense financial strain faced by a significant portion of the population.

Seeking Solutions Amidst the Crisis

Addressing the Urgent Need for Stability

The escalating inflation rates have propelled a dire need for comprehensive measures to restore stability. While the CBN’s tightened policies offer a glimmer of hope, a collective effort from government, financial institutions, and policymakers is imperative to alleviate the burden on the populace.

Striving for a Sustainable Future

Efforts to stabilize prices and ensure the availability of essential commodities at affordable rates should be a top priority. Long-term strategies aimed at bolstering the economy and curbing inflationary pressures are vital for Nigeria’s economic recovery.

Conclusion: The Road Ahead

Navigating through Nigeria’s inflation crisis demands concerted efforts and proactive measures. Understanding the voices of those affected underscores the urgency to address the pressing challenges. With collaborative action and sustained policies, Nigeria can pave the way for a more stable and prosperous economic landscape for its citizens.

This period demands unity, strategic planning, and resilience from both policymakers and citizens alike. As Nigeria navigates this challenging economic chapter, the resolve to overcome and rebuild remains unwavering.

You must be logged in to post a comment Login