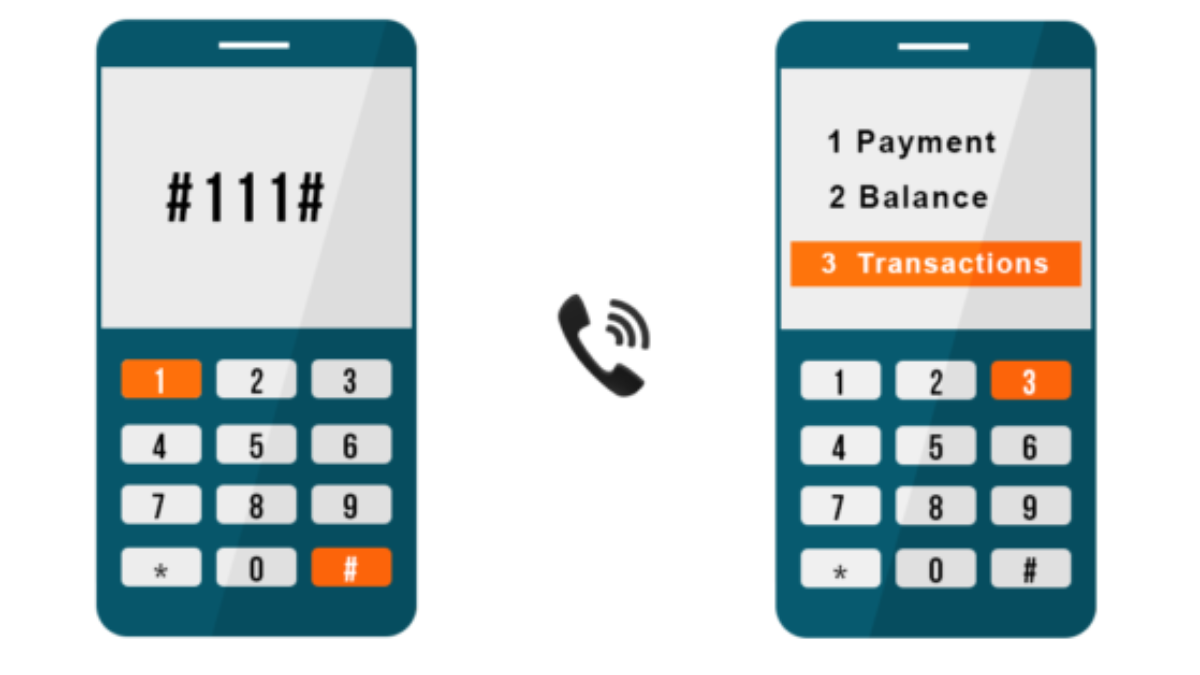

Bank customers using the unstructured supplementary service data (USSD) payment channels will now pay a flat fee of N6.98 per transaction — replacing the current N4.89 session billing structure.

Deposit Money Banks (DMBs) on Friday commenced the implementation of the new charges.

The implementation of the new billing structure comes more than two months after mobile network operators (MNOs) announced plan to suspend USSD services over N42 billion debt owed by financial service providers.

However, the suspension of the service was halted following intervention of Isa Pantami, minister of communications and digital economy.

Following the minister’s intervention, the MNOs and DMBs agreed to reduce the charge on customers.

In March, a joint statement released by the Central Bank of Nigeria (CBN) and the Nigerian Communications Commission (NCC) noted that the new N6.98 per transaction provides a cheaper average cost for customers and enhance financial inclusion.

“This replaces the current per session billing structure, ensuring a much cheaper average cost for customers to enhance financial inclusion. This approach is transparent and will ensure the amount remains the same, regardless of the number of sessions per transaction,” the statement read.

“To promote transparency in its administration, the new USSD charges will be collected on behalf of MNOs directly from customers bank accounts. Banks shall not impose additional charges on customers for use of the USSD channel.

“A settlement plan for outstanding payments incurred for USSD services, previously rendered by the MNOs, is being worked out by all parties in a bid to ensure that the matter is fully resolved.”

On Friday, MTN Nigeria also confirmed the implementation of the plan, saying the deductions will commence on June 3.

“Effective 3rd June, 2021, each USSD Banking transaction will attract a charge of N6.98 exclusive of VAT for use of the USSD Banking channel. The money will be deducted from your bank, by your bank,” the teleco tweeted in response to an inquiry.

Ikechukwu Adinde, director of public affairs at Nigeria Communications Commission (NCC), told The Cable that said the policy is not new, and it ought to have been implemented in March 2021.

“If banks delayed it and they are just implementing the policy, fine,” Adinde said.

“The March joint statement between the CBN and NCC clearly state positions on the matter.”

You must be logged in to post a comment Login