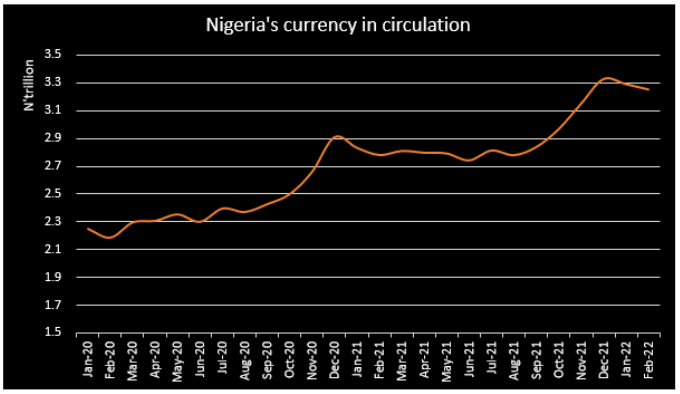

Currency in circulation in Nigeria fell by N37.94 billion in February to N3.25 trillion compared to N3.29 trillion recorded as of January 2022.

This represents a 1.2% decline on a month-on-month basis, while when compared to the corresponding period of 2021, it increased by 16.95% compared to N2.78 trillion as of February 2021.

This is according to data from the money and credit report of the Central Bank of Nigeria (CBN).

Nigeria’s currency circulating in the economy has recorded significant growth since the Central Bank maintained its dovish monetary approach as a means to ensure the recovery of the nation’s economy, following the recession recorded in 2020, caused by the covid-19 pandemic.

Nairametrics had reported that the several intervention policies pushed currency in circulation to its highest level in history in December 2021. However, it has recorded a decline in two consecutive months, dropping by N37.13 billion in January and N37.84 billion in February 2022.

Private sector credit increased by N1.46 trillion

Credit by banks to the private sector increased by N1.46 trillion in February to N36.91 trillion from N35.45 trillion recorded as of the previous month. This represents an increase 4.1% month-on-month.

- This is significantly higher than the additional gain of N257.45 billion recorded in the previous month, largely due to the borrowing policy to stimulate economic growth by the CBN.

- Meanwhile, currency outside the banks as of February 2022 was N2.73 trillion, which is 1.7% lower than the N2.78 trillion as of the previous month, representing a decline of N47.53 billion.

- Banks’ credit to government also increased by 4.5% in February 2022, improving from N14.28 trillion recorded as of January 2022 to N14.92 trillion.

- The growth in credit to both private and government parastatal could be attributed to the Central Bank’s policies to stimulate the economy. Also, innovation in technology and the surge in the number of FinTechs in the lending space has brought more competition to the lending space.

What the CBN is saying

According to the communique of the recent 284th MPC meeting, the CBN has disbursed a sum of N29.67 billion between January and February 2022 under the Anchor Borrowers’ Programme (ABP) for the procurement of inputs and cultivation of maize, rice, and wheat.

- These disbursements bring the total under the programme to over 4.52 million smallholder farmers, cultivating 21 commodities across the country, comes to a total of N975.61 billion.

- Also, the apex bank released N19.15 billion to finance 5 large-scale agricultural projects under the Commercial Agriculture Credit Scheme (CACS), bringing the total disbursements under the Scheme to N735.17 billion for 671 projects in agro-production and agro-processing.

- In addition to these, the Bank disbursed the sum of N428.31 billion under the N1 trillion Real Sector Facility to 37 additional projects in the manufacturing, agriculture, and services sectors.

- Additionally, under the 100 for 100 Policy on Production and Productivity (PPP), the Bank has disbursed the sum of N29.51 billion to 31 projects, comprising 16 in manufacturing, 13 in agriculture, and 2 in healthcare.

The Monetary Policy Committee (MPC) of the Central Bank voted to hold the MPR at 11.5%, keeping other parameters constant as six of the members voted to hold, three members voted to raise MPR by 25-basis points, while only one member voted a 50-basis points raise.

FOR MORE INFORMATION VISIT: https://ksbcjournal.com/

You must be logged in to post a comment Login