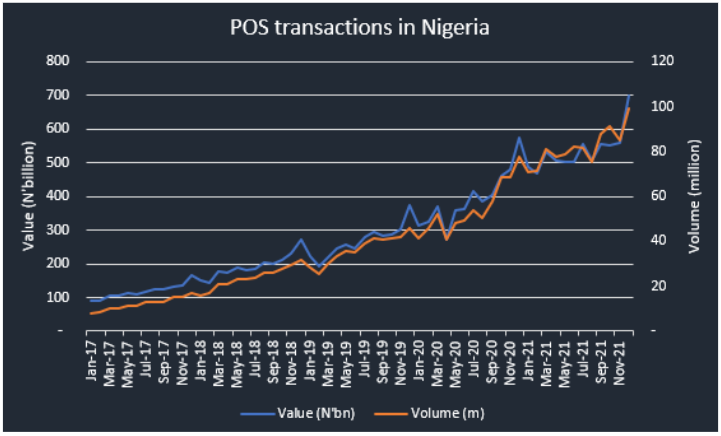

Nigeria recorded a total of N6.43 trillion as POS transactions in 2021, hitting the highest levels on record. Nigeria’s acceptance for digital means of payment has improved in recent time, however, the Christmas festivity contributed significantly to the surge in the review year.

Notably, POS transactions in December, rose to N699.75 billion, which is the highest ever recorded in a single month. This is according to the recently released data on payment channels by the Nigeria Interbank Settlement System (NIBSS).

Similarly, the volume of POS transactions in the country skyrocketed by 50% to 982.8 million in 2021 compared to 655.8 million transactions recorded in the previous year. It also represents the highest number of transactions ever recorded since the adoption of Point of Sale transactions in Nigeria.

A glance at the historic data from the Central Bank shows that POS adoption has grown significantly compared to when the CBN introduced the agent banking system in 2012. In the maiden year, POS transactions stood at N46.86 billion, which has now recorded a significant increase in multiples nine years down the line.

An analytical perspective of the data from the NIBSS shows a significant hike in POS transactions in the month of December dating back to 2017. It has been a pattern for Nigeria’s spending to increase during the festive period. The diagram above gives an indication of the trend usually at the tail end of the year, where there is usually a spike in POS transactions before levelling at the start of the new year.

Why the surge?

- Nigeria’s adoption of digital financial services has increased in recent years, which was further amplified by the Covid outbreak in the country, forcing Nigerians to look for other means of performing their financial transactions from the comfort of their homes.

- A development, which presented an opportunity for business-savvy Nigerians mostly youths to create mobile banks and POS shops across the country. Helping Nigerians to perform withdrawals, deposits and transfer of funds without the hassle of queuing at the banking halls.

- Meanwhile, the spending habit of Nigerians during the Christmas period typically referred to as “Detty December” has always been on the high side, with shopping, travelling and all-round fun being the prevailing order during this period.

- Nigerians during this period troop in their numbers to cinemas to view latest movies, which has been fully capitalised on by local movie producers as they now try to premier their movies into the festivity.

- The high spending during the Christmas festivity is also reflected in the consumer price index, as the NBS reported a jump in Nigeria’s inflation rate in December 2021 to 15.63% despite witnessing 8 consecutive months of moderations.

- A major incentive for the adoption of more digital means of payment rather than physical cash payments is the level of insecurity in the country. It is easier and safer to make payments through your ATM or virtual cards in Nigeria, especially with the increased cases of robbery, bag snatching, kidnapping amongst others.

On the other hand, conventional use of payment, one of which includes the use of cheques has witnessed a consistent decline since the improved adoption of POS means of transactions. According to the data from the NIBBS, Nigeria recorded cheque transactions in 2021 valued at N3.22 trillion, a marginal decline compared to N3.27 trillion recorded in the previous year.

Compared to five years ago, it dropped by 40.2% compared to N5.38 trillion recorded in 2017, further indicating a switch in from conventional methods to digital means. As much as Nigerians continue to increase their usage of the POS, the number of terminals across the country also has witnessed improvement in recent times.

According to the NIBSS, the number of registered POS terminals in the country rose to 976,898 in June 2021, just a little under 1 million, compared to 523,488 registered as of the same period in 2020. Meanwhile, deployed POS machines as of June 2021, stood at 638,983.

What this means

The increase in e-payment transactions in Nigeria is a reflection of Nigerians growing adoption of cashless transactions and improve digital penetration in the country. The surge in POS transactions also reflects on the top line of Nigerian banks, with twelve of the listed commercial banks on the Stock market raking in a sum of N200.5 billion from their e0business income between January and September 2021.

Similarly, it has also been a major form of employment for Nigerian youths, helping bridge the unemployment gap in the country.

FOR MORE INFORMATION VISIT: https://ksbcjournal.com/

Article Originally Published Here

You must be logged in to post a comment Login