Market jitters as Middle East tensions rattle Asian Stocks amid looming Central Bank meetings and German interest in Nigeria’s energy sector sparks hopes for new economic partnerships and infrastructural development.

Asian markets experienced a slip due to apprehensions about potential escalations in the region following Israel’s movements in Gaza. The concerns are magnified as central bank meetings in the United States, Britain, and Japan approach. Alongside these geopolitical concerns, several key companies, including Apple, Airbnb, McDonald’s, Moderna, and Eli Lilly & Co are set to release their quarterly earnings this week.

Impact on Asian Stock Markets

- MSCI’s broadest index of Asia-Pacific shares outside Japan eased 0.2%, hitting a one-year low last week.

- Japan’s Nikkei 225 slid 0.96%, while the Topix lost 0.91% in early trading.

- South Korea’s Kospi experienced a marginal drop, but the small-cap Kosdaq rose 0.54%.

HSBC Bank Reports Strong Profit Growth, Misses Analysts’ Expectations

HSBC Bank announced a pretax profit of $7.7 billion for the third quarter, more than doubling its profits. However, this fell short of the $8.1 billion estimated by analysts. The bank’s operating expenses saw a 2% increase due to amplified technology spending and performance-related payouts. Moreover, HSBC revealed plans for a new $3 billion buyback program, suggesting confidence in its future growth.

Germany’s Interest in Nigeria’s Energy Sector

German Chancellor Olaf Scholz expressed his country’s interest in investing in Nigeria’s gas and critical minerals, showcasing the growing importance of the energy-rich region. Scholz also hinted at German companies’ potential involvement in building railways, a sector currently dominated by Chinese companies, indicating a shift in the dynamics of foreign investment in the region.

The US Auto Workers Union Secures Favorable Concessions

The United Auto Workers in the US clinched a significant victory, obtaining major concessions on wages, benefits, and investments from Ford, with a pay hike of at least 30% for full-time workers and a potential doubling of pay for others. Meanwhile, negotiations continue with General Motors, and the Union’s President has ordered a walkout at GM’s Spring Hill, Tennessee, plant in a show of strength and solidarity.

Australia-EU Free Trade Agreement Talks Collapse

The hopes for a Free Trade Agreement between Australia and the European Union were shattered as both parties failed to find common ground on crucial issues. Australian Trade Minister Don Farrell emphasized the inability to reach a compromise that would benefit both Australia and the EU, underscoring the challenges of bridging gaps in global trade agreements.

Retail Sales Boost in Australia

Australia witnessed a notable surge in retail sales, rising by 0.9% in September compared to a 0.2% increase in August, surpassing market expectations of a 0.3% increase. This growth signals positive momentum for the Australian retail sector, demonstrating resilience and consumer confidence despite global economic uncertainties.

Anticipation Surrounding Central Bank Meetings

Market attention is fixated on the upcoming two-day US Federal Reserve monetary policy meeting. Although markets have factored in a pause, investors are closely monitoring the monetary policy statement and Chair Powell’s remarks to position themselves for the December meeting. The likelihood of an interest rate hike has dwindled to less than 20%, a notable shift in market expectations.

ECB Concludes Rate Hike Process

The European Central Bank (ECB) declared the conclusion of its rate hike process, citing a decline in inflation and expressing confidence in reaching the ECB target by 2025. This decision underscores the ECB’s vigilance in assessing economic indicators and its commitment to maintaining stable economic conditions within the Eurozone.

China’s Stringent Regulations Impact Tech IPOs.

China’s tech IPOs faced a dramatic plunge as regulators imposed strict measures on startups, marking a significant shift in the country’s approach to encouraging innovation. The move aims to nurture domestic tech champions that align with Beijing’s vision for technological self-sufficiency. Notably, a record number of companies have canceled or suspended IPO applications on Shanghai’s Star Market this year, reflecting the evolving regulatory landscape in China.

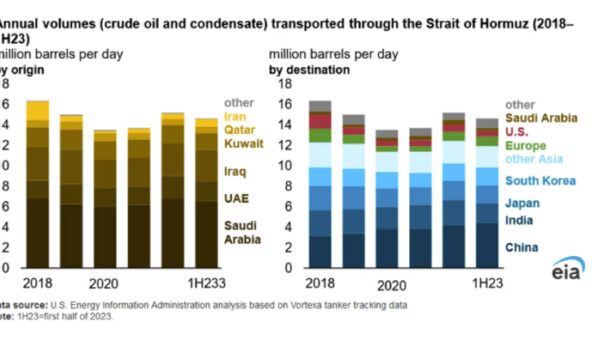

Global Impact of the Middle East Tensions

Oil prices witnessed a slight decrease as concerns about demand outweighed the risks to Middle East supplies. The global market closely monitors developments in the region for potential impacts on oil prices and market stability. Gold prices remained steady at $2,003 an ounce, offering stability in the midst of market fluctuations.

Africa’s Energy and Economic Landscape

Egypt Grapples with Declining Natural Gas Imports

Egypt faced a significant reduction in natural gas imports, leading to an increased frequency of power cuts. The surge in power consumption, coupled with a decline in renewable energy generation, has exacerbated the energy crisis, highlighting the need for sustainable energy solutions and efficient resource management in the region.

Legal Setback for Tiger Brands in South Africa

Consumer goods giant Tiger Brands suffered a setback in its legal pursuit against its former procurement manager in South Africa. The National Prosecuting Authority’s decision not to prosecute raises doubts about the recovery of significant losses incurred by Tiger Brands. The legal uncertainty underscores the challenges faced by corporations in navigating the legal landscape while seeking restitution for financial losses.

Zimbabwe’s Extension of the Multi-Currency System

Zimbabwe’s government extended its multi-currency system, anchored by the US dollar, until 2030, reversing its earlier decision to terminate the system by 2025. The government’s revised stance aims to alleviate uncertainty in the banking sector and provide stability for businesses, signaling the authorities’ commitment to fostering a conducive economic environment in Zimbabwe.

Legal Proceedings Against the Former Nigerian Oil Minister

Former Nigerian oil minister and OPEC President Diezani Alison-Madueke faced legal proceedings in the Southwark Crown Court in London, highlighting the global ramifications of corruption charges in the energy sector. The case exemplifies international efforts to combat corruption and enforce accountability within the energy industry.

Nigeria’s Efforts to Ensure Crude Oil Supply

The Nigerian Upstream Petroleum Regulatory Commission (NUPRC) initiated measures within the provisions of the Petroleum Industry Act (2021) to guarantee a consistent supply of crude oil to emerging refineries in the country. The commission’s proactive approach underscores Nigeria’s commitment to strengthening its energy infrastructure and fostering a sustainable energy sector that supports the nation’s economic growth and development.

Dangote Cement’s Performance in Nigeria and Pan-African Operations

Dangote Cement recorded notable growth in its Nigerian operations, reporting substantial revenue and profit increases. However, the company’s pan-African operations faced a decline, highlighting the complexities and challenges of operating in diverse markets. Dangote Cement’s performance demonstrates the interplay between regional market dynamics and global economic forces in the cement industry.

For further insights and analysis on these global business developments, we turn to Arise business analyst Chika Mbonu for an in-depth examination of the latest market trends and their potential implications for the global economy.

You must be logged in to post a comment Login