In the economic world, leaders often adopt policies to shape their country’s image and influence on the global stage. One such policy gaining attention is China’s shift towards a strong yuan, echoing a move made by the US in the 1990s.

This article explores the promises and perils of China’s strong yuan policy, its implications for the global economy, and the potential challenges it might bring for China itself.

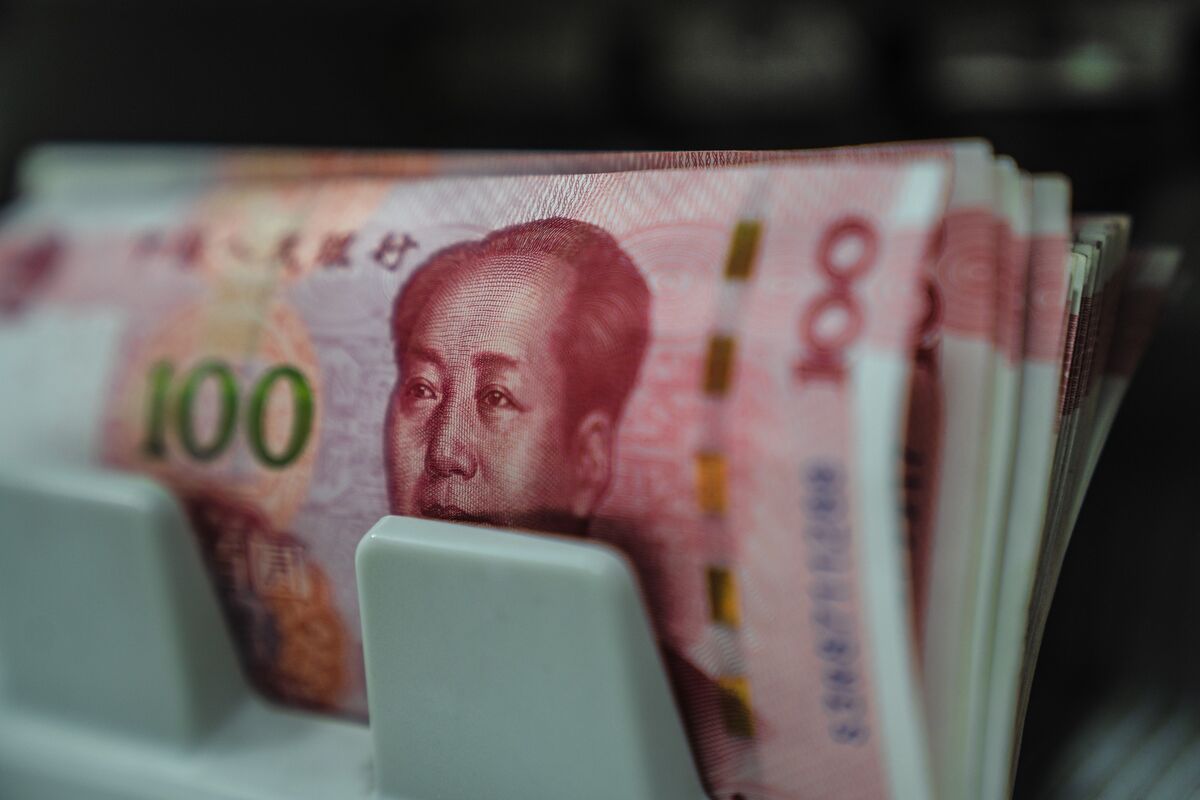

A Turnaround in China’s Currency Policy

In the mid-1990s, China actively intervened in the foreign exchange market to maintain a low-value yuan, benefiting exporters and promoting industrialization.

Fast forward to 2019, and China has largely abandoned this approach, embracing a more globally integrated position. However, Chinese President Xi Jinping is now steering the country in a new direction, aiming to establish China as a global financial power.

The Quest for Global Financial Power

President Xi envisions China as a “financial power,” emphasizing the importance of a strong yuan. This move aims to position the yuan as a stable and appreciating asset, potentially serving as a reserve-currency anchor globally.

Xi’s goal, outlined in his recent state-of-the-union equivalent, hinges on several key elements, with a “strong currency” taking the lead.

Navigating Economic Challenges

Despite the potential benefits, pursuing a strong yuan policy isn’t without its challenges. Recent years have seen China facing depreciation pressures, influenced by factors such as the US Federal Reserve’s monetary policies and concerns about a slowdown in Chinese growth.

To counter this, Beijing implemented various measures, showcasing its determination to defend the yuan and correct market expectations.

The Risks of a Weakening Currency

While a weaker yuan can enhance Chinese exports’ competitiveness, it comes with a downside. Headlines about the yuan hitting its lowest levels since the global financial crisis may discourage global investors from putting their money into China. This echoes a sentiment seen in the mid-1990s when the US faced a “sell USA” narrative, eventually countered by strong dollar rhetoric.

Xi Jinping’s Financial Focus

President Xi’s commitment to making China a major financial power was made explicit in a recent address. In an unexpected move, he directed attention to China’s financial system, a subject not covered in over two decades. This focus on finance, according to experts, signifies a major shift in China’s policy priorities, with the financial system taking center stage.

Unintended Consequences of a Strong Yuan

Despite the potential benefits, a strong yuan policy may have unintended consequences for China. Chief China economist Rory Green warns that it could constrain monetary policy, as the People’s Bank of China may hesitate to ease policies that could weaken the exchange rate. Striking a balance between a strong currency and a robust economy is crucial to avoid unfavorable outcomes.

Encouraging Offshore Financial Markets

On the flip side, a focus on protecting the yuan’s value could stimulate the growth of offshore financial markets denominated in China’s currency. This could lead to the expansion of offshore yuan bonds, as evidenced by recent plans from Singapore’s Temasek and South Korea’s Korea Development Bank. Such developments might contribute to the internationalization of the yuan.

Conclusion

China’s adoption of a strong yuan policy marks a significant shift in its economic strategy. While it aims to bolster its global financial standing, there are potential risks and challenges associated with this approach.

The world watches closely as China navigates the complexities of currency policies, impacting not only its own economic landscape but also the global financial order.

You must be logged in to post a comment Login